Revision Notes

Money and Credit

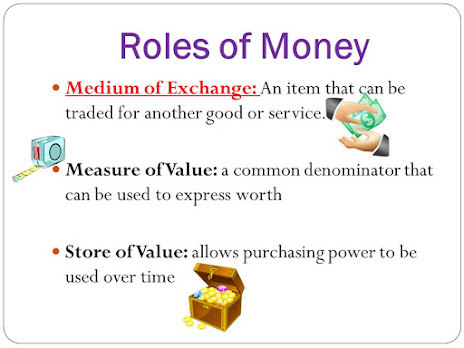

MONEY AS A MEDIUM OF EXCHANGE:

1. A person holding money can exchange it for any commodity or service that he or she might want.

2. Thus everyone prefers to receive payments in money and then exchange the money for things that they want.

3. Both parties have to agree to sell and buy each other commodities. This is known as a Double coincidence of wants.

4. What a person desires to sell is exactly what the other wishes to buy.

5. In a barter system where goods are directly exchanged without the use of money, the double coincidence of wants is an essential feature.

6. In contrast, in an economy where money is in use, money by providing the crucial intermediate step eliminates the need for double coincidence of wants.

7. Money acts as an intermediate in the exchange process, it is called a medium of exchange. This is known as Barter System.

MODERN FORMS OF MONEY:

1. We have seen that money is something that can act as a medium of exchange in transactions.

2. Before the introduction of coins, a variety of objects was used as money.

3. For example, since the very early ages, Indians used grains and cattle as money.

Currency:

1. Modern forms of money include currency – paper notes and coins.

2. Money is accepted as a medium of exchange because the currency is authorized by the government of the country.

3. In India, the Reserve Bank of India issues currency notes on behalf of the central government.

4. As per Indian law, no other individual or organization is allowed to issue currency.

5. No individual in India can legally refuse a payment made in rupees.

Deposits with Bank:

1. The other form in which people hold money is as deposits with the bank.

2. People deposit money with the banks by the opening a bank account in their name.

3. Banks accept the deposits and also pay an amount as interest on the deposits.

4. People also have the provision to withdraw the money as and when they require.

5. Since the deposits in the accounts can be withdrawn on demand, these deposits are called demand deposits.

6. It is this facility which lends it the essential characteristics of money.

7. You would have heard of payments being made by cheques instead of cash.

8. For payment by cheque, the buyer who has an account with the bank, make out a cheque for a specific amount.

9. A cheque is a paper instructing the bank to pay a specific amount from the person’s account to the person in whose name the cheque has been issued.

10. The facility of cheque against demand deposits makes it possible to directly settle payments without the use of cash.

11. Since demand deposits are accepted widely as a means of payment, along with currency, they constitute money in the modern economy.

12. But for the banks, there would be no demand and no payments by cheques against these deposits. The modern forms of money – currency and deposits – are closely linked to the working of the modern banking system.

LOAN ACTIVITIES OF BANKS:

1. Banks keep only a small proportion of their deposits as cash with themselves.

2. This is kept as a provision to pay the depositors who might come to withdraw money from the bank on any given day.

3. Since, on any particular day, only some of its many depositors come to withdraw cash, the bank is able to manage with this cash.

4. Banks use the major portion of the deposits to extend loans.

5. There is a huge demand for loans for various economic activities.

6. Banks make use of the deposits to meet the loan requirements of the people.

7. In this way, banks mediate between those who have surplus funds and those who are in need of these funds.

8. Banks charge a higher interest rate on loans than what they offer on deposits.

9. The difference between what is charged from borrowers and what is paid to depositors is their main source of income.

TERMS OF CREDIT:

1. Every loan agreement specifies an interest rate which the borrower must pay to the lender along with the repayment of the principal addition, lenders may demand collateral against the loan.

2. Collateral is an asset that the borrower owns and uses this as a guarantee to a lender until the loan is repaid.

3. The interest rate, collateral and documentation requirement, and the mode of repayment together comprise what is called the terms of credit.

FORMAL SECTOR CREDIT IN INDIA:

1. We have seen that people obtain loans from various sources.

2. The various types of loans can be conveniently grouped as formal sector and informal sector loans.

3. Among the former are loans from banks and cooperatives.

4. The informal lenders include moneylenders, traders, employers, relatives and friends, etc.

5. The Reserve Bank of India supervises the functioning of formal sources of loans.

6. For instance, we have seen that the banks maintain a minimum cash balance out of the deposits they receive.

7. The RBI monitors the banks in actually maintaining a cash balance.

8. Periodically, banks have to submit information to the RBI on how much they are lending, to whom, at what interest rate, etc.

9. There is no organization that supervises the credit activities of lenders in the informal sector.

10. They can lend at whatever interest rate they choose.

11. There is no one to stop them from using unfair means to get their money back.

12. Compared to the formal lenders, most of the informal lenders charge a much higher interest on loans.

13. Thus, the cost to the borrower of informal loans is much higher.

14. The Higher cost of borrowing means a large part of the earnings of the borrowers is used to repay the loans.

15. Cheap and affordable credit is crucial for the country’s development.

Formal and Informal Credit: Who gets what?

1. 85% of the loans taken by poor households in the urban areas are from informal sources.

2. Urban households take only 10% of their loans are from informal sources, while 90% are from formal sources.

3. The rich households are availing cheap credit from informal lender whereas the poor households have to pay a large amount of borrowing.

4. The formal sector still meets only about half of the total credit needs of the rural people.

5. The remaining credit needs are met from informal sources.

6. Thus, it is necessary that banks and cooperatives increase their lending particularly in the rural areas so that the dependence on informal sources of credit reduces.

7. While formal sector loans need to expand, it is also necessary that everyone receives these loans.

8. It is important that the formal credit is distributed more equality so that the poor can benefit from the cheaper loans.

SELF-HELP GROUPS FOR THE POOR:

1. In the previous section, we have seen that poor households are still dependent on informal sources of credit.

2. Banks are not present everywhere in rural India.

3. Even when they are present, getting a loan from a bank is much more difficult than taking a loan from informal sources.

4. The absence of collateral is one of the major resources which prevent the poor from getting the bank loans.

5. Informal lenders such as moneylender, on the other hand. Known the borrowers personally and hence are often willing to give a loan without collateral.

6. However, the moneylenders charge very high rates of interest, keep no records of the transactions and harass the poor borrower.

7. In recent years, people had tried out some newer ways of providing loans to the poor.

NCERT Solutions

Money and Credit

Question 1. In situations with high risks, credit might create further problems for the borrower. Explain.

Answer: This statement is true "In situations with high risks, credit might create further problems for the borrower". This is also known as a debt-trap. Taking credit involves an interest rate on the loan and if this is not paid back, then the borrower is forced to give up his collateral or asset used as the guarantee, to the lender. If a farmer takes a loan for crop production and the crop fails, loan payment becomes impossible. To repay the loan the farmer may sell a part of his land making the situation worse than before. The farmer had taken a loan to improve his situation but his situation worsens due to nonpayment of loans. Since farming is associated with high uncertainty, debt trap is common. Thus, in situations with high risks, if the risks affect a borrower badly, then he ends up losing more than he would have without the loan.

Question 2. How does money solve the problem of double coincidence of wants? Explain with an example of your own.

Answer: In a barter system where goods are directly exchanged without the use of money, the double coincidence of wants is an essential feature. By serving as a medium of exchanges, money removes the need for double coincidence of wants and the difficulties associated with the barter system. For example, it is no longer necessary for the farmer to look for a book publisher who will buy his cereals at the same time sell his books. All he has to do is find a buyer for his cereals. If he has exchanged his cereals for money, he can purchase any goods or service which he needs. This is because money acts as a medium of exchange.Medium of exchange is one of the three fundamental functions of money in mainstream economics. It is a widely accepted token which can be exchanged for goods and services.

Question 3. How do banks mediate between those who have surplus money and those who need money?

Answer: Banks accept deposits from people who have surplus money, paying interest on these deposits. The banks use the major portion of the deposits to extend loans to those who need money, charging them slightly higher interest than what they pay to the depositors. It is with the banks help both the people benefit,person having surplus money and the person in need of money. In this way, banks mediate between those who have surplus money and those who need money.

Question 4. Look at a 10 rupee note. What is written on top? Can you explain this statement?

Answer: The following words are written on the top of a 10 rupee note:

Reserve Bank Of India

Guaranteed by the Central Government of India

I promise to pay the bearer the sum of Ten Rupee

A 10 rupee note is acceptable as a medium of exchange because it is authorized by the government of India. In India, Reserve Bank of India issues currency notes on behalf of the central government. The statement means that the currency is authorized or guaranteed by the Central Government. That is, Indian law legalizes the use of rupee as a medium of payment that can not be refused in setting transaction in India. As a promise written on a promissory note, the RBI promises the bearer to pay the given sum of money.

Question 5. Why do we need to expand formal sources of credit in India?

Answer: We need to expand formal sources of credit in India due to:

- To reduce dependence on informal sources of credit because the latter charge high interest rates and do not benefit the borrower much.

- Cheap and affordable credit is essential for country’s development. The formal sector still meets only about half of the total credits needs of the rural people.

- Banks and co-operatives should increase their lending, particularly, in rural areas. Rural borrowers depend on informal sources like moneylenders who charge them a high rate of interests, which can sometimes land them into a debt-trap.

- This would lead to higher incomes and many people will be able to borrow cheaply for a variety of needs. They will be able to grow crops, do business, set up small scale industries etc.

Question 6. What is the basic idea behind the SHGs for the poor? Explain in your own words.

Answer: The basic idea behind the formation of SHGs is to create self-employment for the poor, particularly rural poor woman. Self-help groups are seen as instruments for goals including empowering women, developing leadership abilities among the poor and the needy people, increasing school enrollments and improving nutrition and the use of birth control. In countries like India, SHGs bridge the gap between high-caste & low-caste members. They also provide timely loans at a responsible interest rate without collateral.

Thus, the main objectives of the SHGs are:

- To organize rural poor especially women into small Self Help Groups. A typical SHGs has 15-20 members.

- To collect savings of their members.

- To provide loans without collateral.

- To provide timely loans for a variety of purposes.

- To provide loans at responsible rate of interest and easy terms.

- Provide a platform to discuss and act on a variety of social issues such as education, health, nutrition, domestic violence etc

Question 7. What are the reasons why the banks might not be willing to lend to certain borrowers?

Answer: The banks might not be willing to lend certain borrowers due to the following reasons:

- Banks require proper documents and collateral as security against loans. Some persons fail to meet these requirements, particularly small farmer requiring crop loan. Repayment of the loan is dependent on crop production which is highly susceptible and depends on monsoons etc.

- The borrowers who have not repaid previous loans, the banks might not be willing to lend them further.

- The banks might not be willing to lend those entrepreneurs who are going to invest in the business with high risks.

- One of the principle objectives of a bank is to earn more profits after meeting a number of expenses. For this purpose it has to adopt judicious loan and investment policies which ensure fair and stable return on the funds.

Question 8. In what ways does the Reserve Bank of India supervise the functioning of banks? Why is this necessary?

Answer: Reserve Bank of India is the central bank of the country and works as the supervising authority over other banks across the country. The Reserve Bank of India supervises the functions of banks in a number of ways:

- RBI checks that the bank actually maintains a minimum cash balance out of the deposit they receive. Currently this is 15%.

- RBI observes that the banks give loans not just to profit making businesses and traders but also to small cultivators, small scale industries, small borrowers etc.

- The commercial banks have to submit information to the RBI on how much they are lending, to whom, at what interest rate etc.

This is necessary to ensure equality in the economy of the country and protect especially small depositors, farmers, small scale industries, small borrowers etc. Further, RBI monitoring ensures that banks do not loan more than they are supposed to, as such an action can create a crisis situation. Great Depression of 1930 is an example of such a crises situation.

Question 9. Analyse the role of credit for development.

Answer: Cheap and affordable credit plays a crucial role in the country’s development. There is a huge demand for loans for various economic activities. The credit helps people to meet the ongoing expenses of production and thereby develop their business. Many people could then borrow for a variety of different needs. Credit helps in expansion of one's business, farmers can grow a variety of crops, procure equipment for farming, send their children for higher education etc. Students get a loan without collateral for higher education which again leads to the development of the nation. In this way, credit plays a vital role in the development of a country.

Question 10. Manav needs a loan to set up a small business. On what basis will Manav decide whether to borrow from the bank or the moneylender? Discuss.

Answer: Manav will decide whether to borrow from the bank or the money lender on the basis of the following terms of credit:

Rate of interest

Requirements availability of collateral and documentation required by the banker.

Mode of repayment. The penalty in case of default in repayment.

Terms of repayment are different of bank and the money lender. Whichever he finds easier he can consider that. Depending on these factors and of course, easier terms of repayment, Manav has to decide whether he has to borrow from the bank or the moneylender.

Question 11. In India, about 80 per cent of farmers are small farmers, who need credit for cultivation.

- Why might banks be unwilling to lend to small farmers?

- What are the other sources from which the small farmers can borrow?

- Explain with an example how the terms of credit can be unfavorable for the small farmer.

- Suggest some ways by which small farmers can get cheap credit.

Answer:

- Bank loans require proper documents and collateral as security against loans. Most of the times the small farmers lack in providing such documents and collateral. Besides, at times they even fail to repay the loan on time because of the uncertainty of the crop. Repayment of the loan is crucially dependent on the income from farming. Therefore banks sometimes are unwilling to lend to small farmers.

- Apart from bank, the small farmers can borrow from local money lenders, agricultural traders, big landlords, cooperatives and SHGs etc.

- The terms of credit can be unfavorable for the small farmer which can be explained by the following - Ramu, a small farmer borrows from a local moneylender at a high rate of interest i.e. 3 percent to grow rice. But the crop is hit by drought and it fails. As a result, Ramu has to sell a part of the land to repay the loan. Credit instead of helping Ramu improve his earnings, left him worse off. He is caught in a debt trap.

- The small farmers can get cheap credit from different sources like – Banks, Agricultural Cooperatives, and SHGs.

Question 12. Fill in the blanks:

- Majority of the credit needs of the poor households are met from informal sources.

- High costs of borrowing increase the debt burden.

- Reserve Bank of India issues currency notes on behalf of the Central Government.

- Banks charge a higher interest rate on loans than what they offer on deposits.

- Collateral is an asset that the borrower owns and uses as a guarantee until the loan is repaid to the lender.

Question 13. Choose the most appropriate answer.

(i) In an SHG most of the decisions regarding savings and loan activities are taken by

(a)Bank.

(b) Members.

(c) Non-government organisation.

Answer : (b) Members.

(ii) Formal sources of credit do not include

(a) Banks.

(b) Cooperatives.

(c) Employers.

Answer : (c) Employers